How can you safeguard your investments against market volatility and maximize your returns? The answer lies in diversification. Building a diversified investment portfolio is crucial for managing risk and enhancing potential returns. This guide will explain the importance of diversification, how to diversify across different asset classes, and provide example portfolios for various risk levels.

Importance of Diversification

Diversification involves spreading your investments across various assets to reduce risk. Here’s why it’s important:

1. Risk Management

By investing in different assets, you can protect your portfolio from significant losses. If one investment performs poorly, others might perform well, balancing the overall return.

2. Enhanced Returns

Diversification can increase your chances of achieving better returns. Different assets perform well under different market conditions, providing growth opportunities.

3. Reduced Volatility

A diversified investment portfolio tends to be less volatile. The performance fluctuations of individual assets are balanced out, leading to a smoother investment experience.

How to Diversify Across Different Asset Classes

Diversifying your investment portfolio involves allocating your funds across various asset classes. Here’s how you can do it:

1. Stocks

Equities represent ownership in a company and offer the potential for high returns. Diversify within stocks by investing in different sectors (e.g., technology, healthcare, finance) and regions (e.g., local, international).

2. Bonds

Fixed-income securities provide regular interest payments and are generally considered safer than stocks. Diversify by investing in government, corporate, and bonds of different maturities.

3. Real Estate

Property investments can provide rental income and capital appreciation. Diversify by investing in residential, commercial, and industrial real estate, as well as real estate investment trusts (REITs).

4. Commodities

Physical goods like gold, silver, oil, and agricultural products can hedge against inflation and market downturns. Diversify within commodities to reduce risk.

5. Cash and Cash Equivalents

Liquid assets such as savings accounts, money market funds, and certificates of deposit (CDs) offer stability and easy access to funds. Keep a portion of your portfolio in cash to manage short-term needs and opportunities.

6. Mutual Funds and ETFs

Pooled investment vehicles like mutual funds and exchange-traded funds (ETFs) allow you to invest in a diversified portfolio of assets. Choose funds with different investment strategies and asset allocations.

Example Portfolios for Different Risk Levels

Your risk tolerance determines the appropriate asset allocation for your diversified investment portfolio. Here are example portfolios for different risk levels:

1. Conservative Portfolio

Objective: Preserve capital and generate income with minimal risk.

This portfolio focuses on maintaining the value of the initial investment and generating steady income through government investments and high-quality corporate bonds, dividend-paying blue-chip stocks, real estate investment trusts (REITs), and cash equivalents. The goal is to protect the investor’s principal while providing consistent returns with low volatility.

Allocation

- 50% Bonds (government and high-quality corporate bonds)

- 20% Stocks (dividend-paying, blue-chip companies)

- 20% Real Estate (REITs and rental properties)

- 5% Commodities (gold and silver)

- 5% Cash and Cash Equivalents (savings accounts, money market funds)

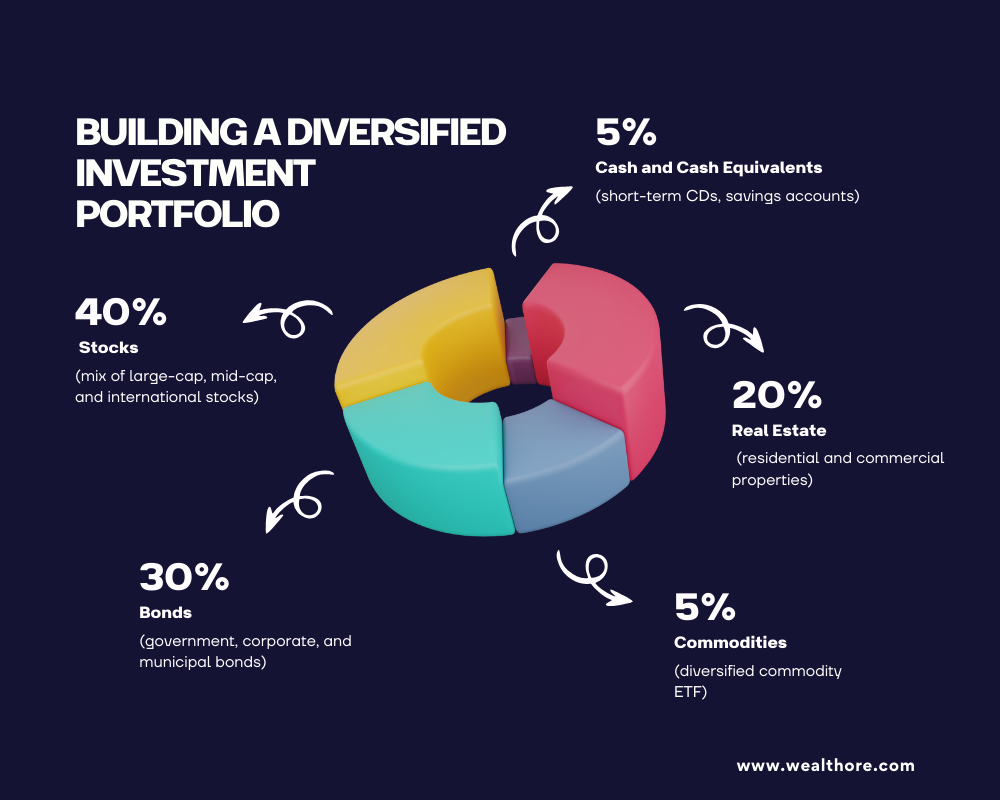

2. Balanced Portfolio

Objective: Achieve a balance between growth and income with moderate risk.

A balanced portfolio aims to combine growth and income while keeping risk at a moderate level. It typically includes a mix of stocks, for higher returns, and bonds, for steady income and stability. Stocks help the portfolio grow, while bonds reduce risk and provide regular interest. This mix ensures the portfolio can achieve good long-term performance without excessive risk.

Allocation

- 40% Stocks (mix of large-cap, mid-cap, and international stocks)

- 30% Bonds (government, corporate, and municipal bonds)

- 20% Real Estate (residential and commercial properties)

- 5% Commodities (diversified commodity ETF)

- 5% Cash and Cash Equivalents (short-term CDs, savings accounts)

3. Aggressive Portfolio:

Objective: Maximize growth potential with higher risk tolerance.

An aggressive portfolio aims for the highest possible growth, accepting higher risk. It mostly includes stocks from small companies, emerging markets, and high-growth sectors. Other high-risk investments like real estate and commodities might also be included. The focus is on increasing value, not generating income, and investors should be prepared for significant ups and downs. This strategy is ideal for those with a long-term outlook who can handle short-term losses for the chance of greater long-term gains.

Allocation

- 70% Stocks (high-growth, small-cap, and emerging market stocks)

- 15% Real Estate (commercial properties and REITs)

- 10% Bonds (high-yield corporate bonds)

- 5% Commodities (oil, agricultural products, and precious metals)

Practical Tips for Building a Diversified Investment Portfolio

1. Assess Your Risk Tolerance

Determine your risk appetite based on your financial goals, time horizon, and comfort with market fluctuations. Your risk tolerance will guide your asset allocation strategy and help you build a diversified investment portfolio that aligns with your objectives.

2. Research and Select Investments

Conduct thorough research on potential investments. Consider factors like historical performance, fees, and alignment with your investment objectives. A well-informed selection process is crucial for creating a diversified investment portfolio.

3. Rebalance Your Portfolio

Regularly review and adjust your portfolio to maintain your desired asset allocation. Market fluctuations can shift your allocation over time, necessitating periodic rebalancing. This ensures that your diversified investment portfolio remains aligned with your risk tolerance and financial goals.

4. Stay Informed

Keep up with market trends, economic news, and changes in the investment landscape. Staying informed helps you make timely decisions and seize opportunities, ensuring the continued effectiveness of your diversified investment portfolio. You can find reliable economic data from sources like the World Bank, the International Monetary Fund (IMF), and reputable financial news websites such as Bloomberg and Reuters. For more insights and tips, visit WealthOre.com.

5. Seek Professional Advice

Consider consulting with a financial advisor or investment professional. They can provide personalized advice and help you design a diversified investment portfolio that aligns with your goals. Professional guidance can be invaluable, especially for new investors.

Conclusion

Building a diversified investment portfolio is essential for managing risk and maximizing returns. By spreading your investments across different asset classes, you can protect your portfolio from significant losses, achieve better returns, and enjoy a smoother investment experience. Remember to assess your risk tolerance, conduct thorough research, and periodically rebalance your portfolio to stay on track with your financial goals.

How do you diversify your investment portfolio, and what strategies have worked best for you? Share your thoughts in the comments below!

[…] What You Need to Know Before Investing Building a Diversified Investment Portfolio June 15, […]

[…] you make timely decisions and seize opportunities, ensuring the continued effectiveness of your diversified investment portfolio. For more insights, check out our latest articles on WealthOre. Additionally, you can find reliable […]

[…] you make timely decisions and seize opportunities, ensuring the continued effectiveness of your diversified investment portfolio. For more insights, check out our latest articles on WealthOre. Additionally, you can find reliable […]

[…] the Basics: Understand different types of investments such as stocks, bonds, and mutual […]

[…] Learn more about the basics of investing from our resources at wealthore.com such as how to build a diversified investment portfolio. […]

[…] For a comprehensive guide on these investments read Renewable Energy Investment Strategies, also check out our detailed article on how to diversify your investment portfolio. […]